As we step into the second week of October 2024, the financial world is poised for a whirlwind of activity. With major economic reports and central bank decisions on the horizon, investors are bracing for market-shifting events. From labor market insights to inflation data, this week’s calendar promises to be pivotal for global markets. Let’s dive into the key events that could shape the financial landscape from October 14 to October 18.

Upcoming Market Events (October 14-18, 2024)

Monday, October 14:

- Holiday: US & Canada (Stock market open, Bond market closed in the US)

- Fed’s Waller Speech

Tuesday, October 15:

- UK Labour Market Report

- German ZEW Economic Sentiment

- Canada Consumer Price Index (CPI)

- New Zealand Q3 CPI

Wednesday, October 16:

- UK CPI Inflation Data

Thursday, October 17:

- Australian Labour Market Report

- ECB Policy Decision

- US Retail Sales, Jobless Claims, Industrial Production, and Capacity Utilization

- US NAHB Housing Market Index

Friday, October 18:

- Japan CPI Inflation

- China Industrial Production & Retail Sales

- UK Retail Sales

- US Housing Starts & Building Permits

Monday, October 14: Fed’s Waller Speech

Monday kicks off with a speech by Christopher Waller, a key member of the Federal Reserve’s board. Investors will be keenly watching his statements, as Waller has been a leading indicator for shifts in the Fed’s policy stance. Recently, Waller hinted that if the labor market softens or inflation drops below expectations, the Fed could expedite rate cuts. On the other hand, a resurgence in inflation could lead to a pause in the Fed’s cutting cycle.

The market is closely aligned with the Fed’s projections, so if Waller downplays recent inflation data, we could see a boost in risk sentiment. This could set the tone for the rest of the week, especially with major inflation data from other countries coming later.

Tuesday, October 15: UK Labor Data, Canada CPI, and New Zealand CPI

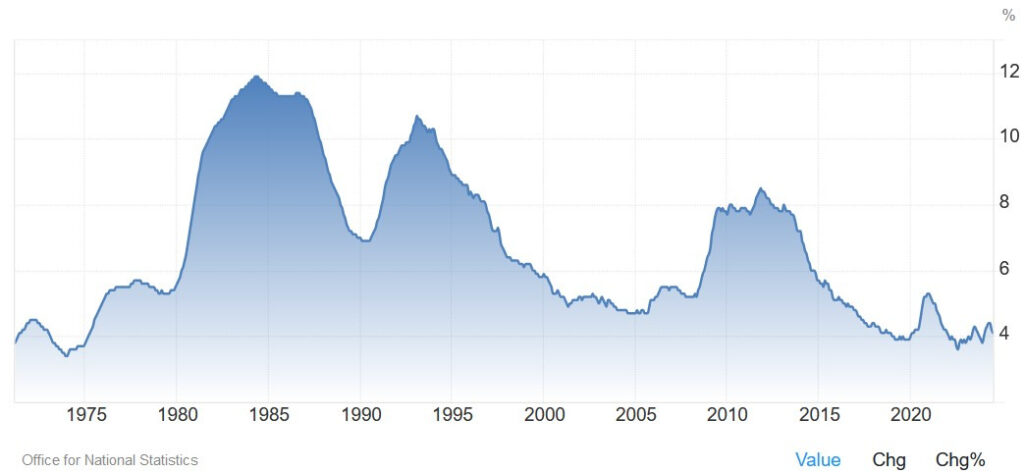

UK Labour Market Report

The UK’s labor market will be under scrutiny as analysts expect the addition of 250K jobs in the three months leading to August, down from the 265K reported in July. The unemployment rate is projected to hold steady at 4.1%. Meanwhile, wage growth, a key indicator of inflationary pressure, is expected to show a slight slowdown. Average weekly earnings, including bonuses, are anticipated at 3.8% versus the previous 4.0%, while earnings excluding bonuses are forecast at 4.9%, down from 5.1%

The Bank of England (BoE) has been hinting at potential rate cuts, with the market pricing in an 80% chance of a 25 basis point (bps) cut in November. However, a notably weak labor report could see markets pricing in even more aggressive cuts, including a possible back-to-back cut in December. A surprise here could jolt the pound and shift expectations on BoE policy.

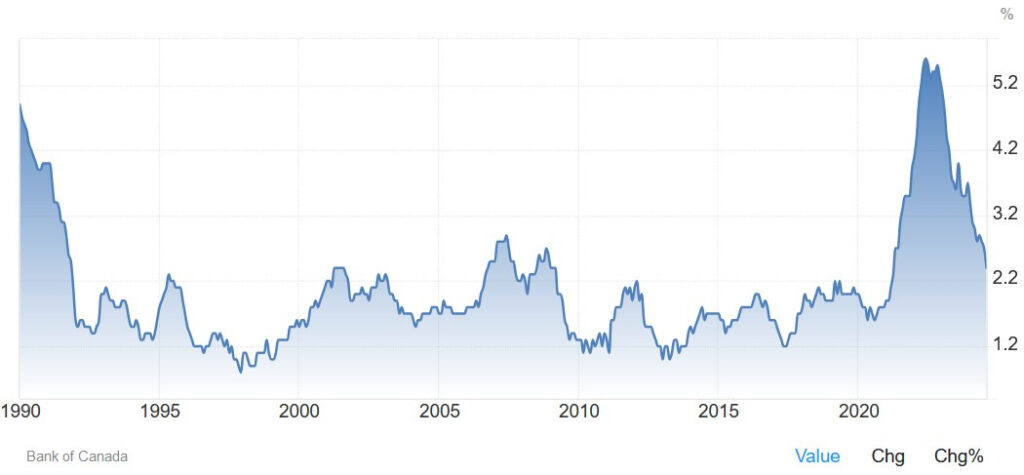

Canada CPI Report

Canada’s inflation data is set to be a key release this week, with markets eyeing the potential for a 50 bps rate cut by the Bank of Canada (BoC). The Canadian CPI is forecast to come in at 1.8% year-over-year (YoY), down from 2.0%, while the month-over-month (MoM) figure is expected to remain at -0.2%. Underlying inflation metrics, like the Trimmed Mean and Median CPI, are critical for the BoC’s outlook, and any softness here could tilt the odds toward more aggressive rate cuts in the near term.

The probability of a 50 bps cut has fluctuated following recent data, with strong retail sales and GDP figures offset by a weaker labor market report. If the CPI comes in soft, expect the markets to increase bets on larger rate cuts by the BoC.

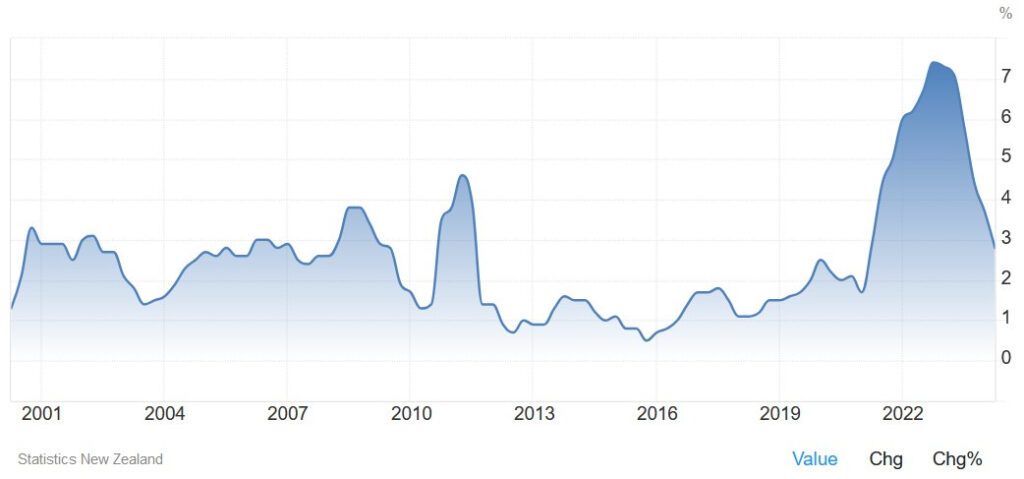

New Zealand Q3 CPI

Across the Pacific, New Zealand will release its Q3 CPI figures, which are expected to show a year-over-year decline to 2.3% from 3.3%. With core inflation recently falling back within the Reserve Bank of New Zealand’s (RBNZ) 1-3% target range, and the labor market showing signs of weakness, the RBNZ has already begun cutting rates aggressively. Another 50 bps cut is expected at the November meeting, and further easing could be in store depending on the CPI outcome.

Wednesday, October 16: UK Inflation Data

UK CPI Report

Inflation remains a critical concern for the UK, with the CPI expected to show a year-over-year decline to 1.9% from 2.2%. Core inflation, which excludes volatile food and energy prices, is projected to fall slightly to 3.4% from 3.6%.

The Bank of England has already priced in a 25 bps cut by year-end, so a hotter-than-expected inflation report likely won’t change that outlook. However, a soft reading could lead to expectations of additional cuts, with some analysts speculating on a 50 bps cut in November if the inflation and labor data come in weaker than anticipated.

Thursday, October 17: ECB Decision, US Data, and Australian Labor Report

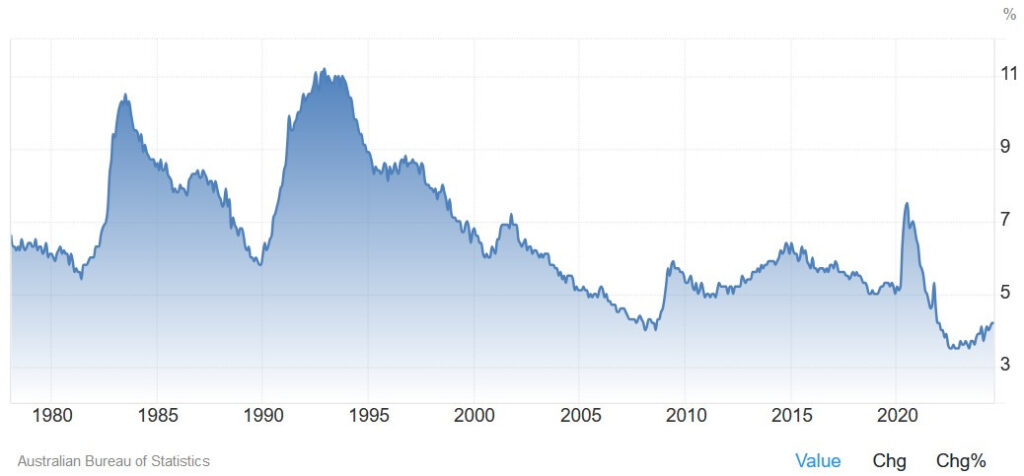

Australian Labour Market Report

Australia’s labor market report is expected to show the addition of 25K jobs in September, down from the 47.5K in August. The unemployment rate is forecast to remain unchanged at 4.2%. While this data may not prompt immediate action from the Reserve Bank of Australia (RBA), which has maintained a hawkish stance, any surprises could influence future rate expectations.

ECB Policy Decision

The European Central Bank (ECB) is expected to cut its policy rate by 25 bps, bringing it to 3.25%. Recent data, including weaker Purchasing Managers’ Index (PMI) figures and benign inflation, have solidified market expectations of this move. Additionally, the market is pricing in another 25 bps cut in December, with further easing expected in 2025. If the ECB adopts a dovish tone in its forward guidance, we could see increased volatility in the euro and European bond markets.

US Economic Data

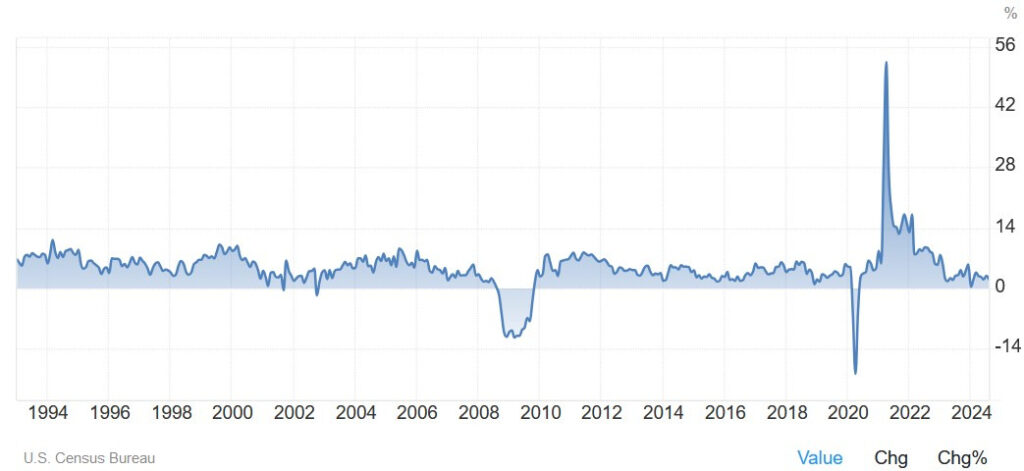

Thursday will be packed with crucial US economic releases, including Retail Sales, Jobless Claims, Industrial Production, and the NAHB Housing Market Index. Retail sales are expected to show a 0.3% month-over-month increase, while the core measure excluding autos is forecast at 0.2%. Consumer spending has remained stable, supported by positive wage growth and a resilient labor market. However, retail sales data can be volatile, so while it may not shift Fed policy expectations, it will still be closely watched by the markets.

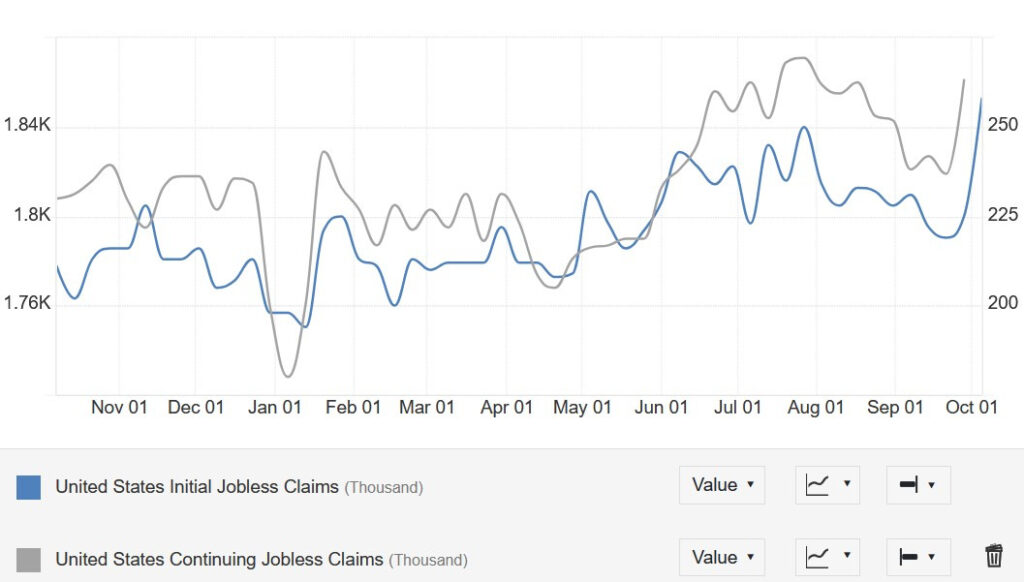

Initial jobless claims, another key labor market indicator, are expected at 255K, down slightly from the previous week’s 258K. Continuing claims are forecast to rise marginally to 1.87 million, following last week’s spike attributed to temporary factors like the Boeing strike and Hurricane Helene.

Friday, October 18: Japan CPI, China Data, and US Housing Market

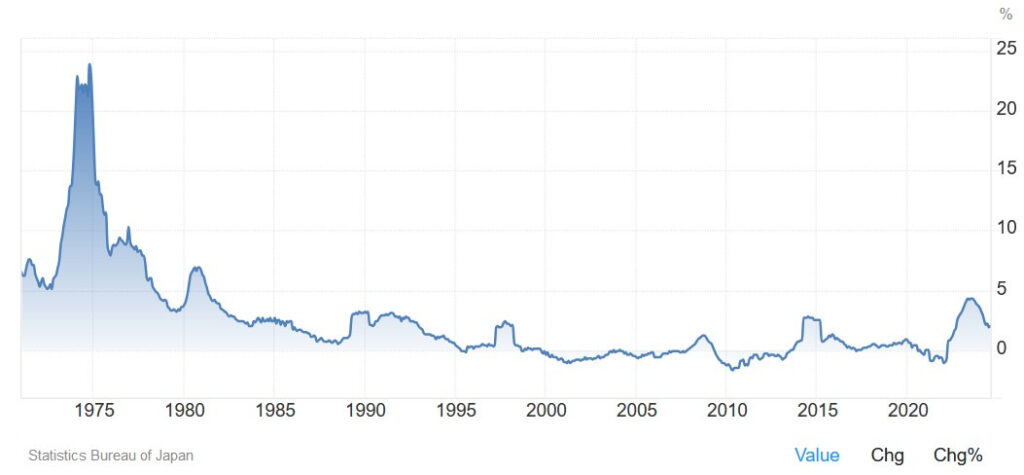

Japan CPI Report

Japan’s inflation data will be in focus, with the Core CPI expected to fall to 2.3% from 2.8%. The Tokyo CPI, often viewed as a leading indicator, has already pointed to a cooling trend. The Bank of Japan (BoJ) recently adopted a more dovish tone due to yen appreciation and weaker inflation. Governor Ueda’s policy stance has shifted to a more neutral tone, but the market is not anticipating a rate hike anytime soon.

China Industrial Production and Retail Sales

China’s industrial production and retail sales figures for September will provide a snapshot of the country’s economic recovery. Industrial production is expected to grow modestly, while retail sales are forecast to show solid gains, reflecting the ongoing rebound in consumer demand. With China still grappling with the aftereffects of its zero-COVID policy, these figures could be crucial for assessing the pace of the country’s economic recovery.

US Housing Starts and Building Permits

To close out the week, US housing data will be in focus with September housing starts and building permits. Both indicators are expected to show slight declines as higher mortgage rates continue to weigh on housing demand. The US housing market has been a key barometer for the broader economy, and any signs of weakness here could impact market sentiment.

Conclusion: Key Themes to Watch

This week is packed with critical economic releases and central bank decisions that will likely move markets. From labor data in the UK and Australia to inflation reports in Canada, New Zealand, and Japan, each event has the potential to shift expectations around monetary policy. The ECB’s rate decision will be a focal point for eurozone markets, while US data will continue to guide the Federal Reserve’s next moves.

With so much at stake, investors should brace for heightened volatility across currencies, bonds, and equities. Stay tuned to see how the week unfolds and what surprises might be in store for the markets.

Leave a Reply