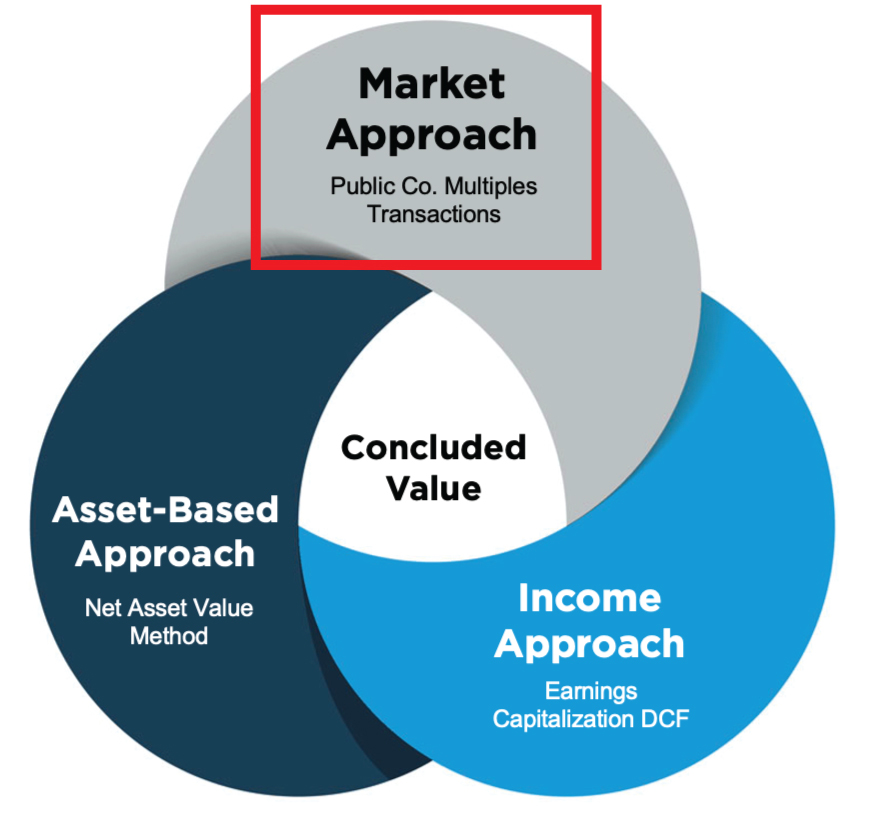

A thoughtful business valuation typically involves multiple approaches to derive an accurate value. One of the three key methods used in business valuation is the market approach, along with the income approach and asset approach. In this article, we’ll focus on the market approach, which involves comparing the subject company to similar businesses that have been sold or are publicly traded.

What Is the Market Approach and How Is It Utilized?

The market approach is a valuation method that determines the value of a business by comparing it to similar companies, securities, or intangible assets that have been sold. There are two primary methods within this approach:

- Guideline Public Company Method: This method uses valuation multiples from publicly traded companies in the same industry as the subject company.

- Guideline Transactions Method: This method uses multiples from mergers and acquisitions (M&A) involving similar businesses.

Additionally, historical transactions in the subject company’s stock can be considered under the guideline transactions method.

Guideline Public Company Method

The guideline public company method involves identifying publicly traded companies that are comparable to the subject company. These companies are analyzed based on financial metrics such as size, profitability, and growth prospects. A valuation multiple is then developed, which expresses the relationship between a company’s value and its performance metric (e.g., EV to EBITDA, P/E ratio).

How It Works:

- The relationship between value and a performance metric is expressed as:Value/metric = multiple

- Applied to the subject company:Metric × multiple = value

The valuation expert will select the most relevant multiples based on the subject company’s characteristics, adjusting for factors like size, risk, and growth prospects. Enterprise value (EV) to sales, EV to EBITDA, and Price to Earnings (P/E) are some common multiples used.

Advantages:

- Relies on objective, empirical data from public companies.

- Daily trading of public stocks ensures minimal gaps between valuation date and data availability.

Drawbacks:

- Public companies are often much larger and more diversified than private companies, making it difficult to find a perfect comparison.

- Industry-specific factors may limit the availability of truly comparable companies.

- Requires significant research and access to financial databases such as Bloomberg, Capital IQ, or TagniFi.

Guideline Transactions Method

The guideline transactions method derives business value from transactions involving comparable companies, often through mergers and acquisitions. This method is sometimes called the M&A method.

How It Works:

- Unlike the public company method, which uses daily stock prices, M&A transactions occur at specific points in time, which introduces challenges related to timing and market conditions.

- The data is sourced from transaction databases, but the reliability of this data can vary, especially for private transactions.

- Transactions may have complex terms, such as earnouts or employment agreements for the primary shareholder, which could affect the deal’s overall valuation.

Advantages:

- The guideline transactions method allows filtering based on size, geographic location, and other relevant attributes, often resulting in more directly comparable companies than those in the public company method.

- Suitable for analyzing private companies that lack publicly traded counterparts.

Drawbacks:

- Market conditions at the time of the transaction may differ from the valuation date.

- Data for private transactions may be self-reported or incomplete, leading to potential inaccuracies.

Transactions in the Stock of the Subject Company

In some cases, recent transactions in the subject company’s stock can provide a valuable indication of its worth. However, these transactions must be “arm’s length,” meaning they were between independent parties acting in their own interests. Transfers between family members or grants to employees are not typically representative of fair market value.

Special Considerations for Startups:

For startup companies, recent capital-raising activities can imply a value. However, it’s important to understand any differences between the interest acquired in those transactions and the interest being valued. For example, venture capital investments often come in the form of preferred stock, which may have unique attributes, such as liquidation preferences or anti-dilution provisions, that make it more valuable than common stock.

Also Read: Understanding the Income Approach in Business Valuation

Conclusion

The market approach is one of the most straightforward and compelling methods for business valuation. It allows for a comparison with similar companies or recent transactions, providing a solid benchmark for determining value. However, each method within the market approach—whether it’s the guideline public company method or the guideline transactions method—has its own strengths and limitations. It’s essential to work with a skilled valuation expert to ensure the methods are applied appropriately, given the unique facts and circumstances of the business in question.

Also read: How to do Valuation Analysis of any Company?

Leave a Reply