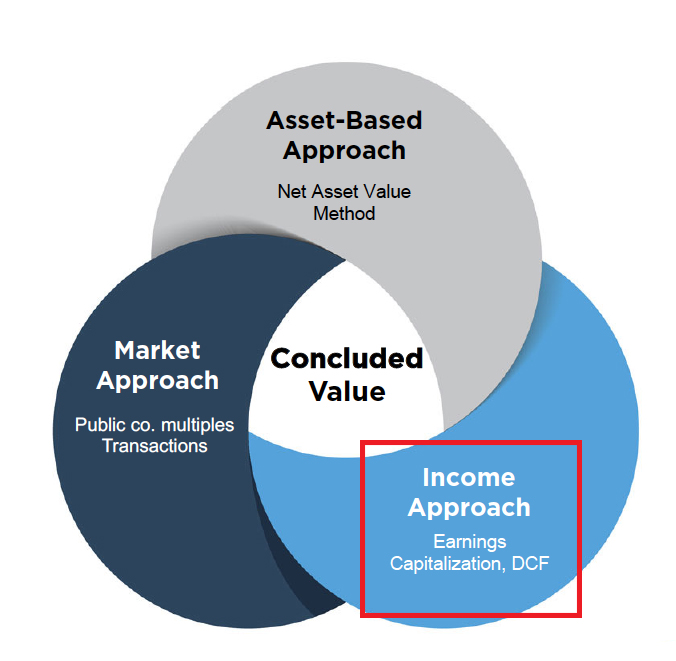

When valuing a business, analysts rely on three primary approaches: the market approach, the income approach, and the asset-based approach. In this article, we’ll provide an in-depth look at the income approach, one of the most commonly used methods in business valuation. The asset-based approach will be covered in a future article.

Each approach should be considered in business valuations, but the final decision on which method to rely on depends on the specific circumstances of the business. Let’s dive into how the income approach works and when it is typically applied.

What Is the Income Approach and How Is It Utilized?

The income approach determines the value of a business by converting future anticipated economic benefits into a present single amount. Essentially, this method values a business based on the present value of all future cash flows the business is expected to generate. This requires estimates of the future cash flows and an appropriate discount rate.

There are two primary categories of methods within the income approach:

- Single-period methods, such as the capitalization of earnings or free cash flow.

- Multi-period methods, like the discounted cash flow (DCF) method.

The choice between these methods depends on several factors, including whether the business is in a growth or mature phase, and if there are reliable budgets or projections available. Analysts also need to assess whether the business’s historical trends provide a reasonable indication of future performance.

When should you use the Income Approach Method of Business Valuation?

- Businesses are profitable

- Valuations for tax returns/IRS

- Specific facts of the subject company including

– Earning Capacity

– Capital Expenditure

– Growth Rates

Normalizing Adjustments: A Key Step in the Income Approach

Before applying any method within the income approach, it is critical to make normalizing adjustments. These adjustments help present the income statement of a private company as if it were publicly traded, revealing a “public equivalent” income stream. There are two main categories of normalizing adjustments:

1. Non-Recurring, Unusual Items

These adjustments remove one-time gains or losses and other irregular items that do not reflect the company’s regular operations. Examples include:

- Legal settlements: One-time legal settlements are eliminated, adjusting earnings accordingly.

- Sale of non-operating assets: Gains from the sale of assets that no longer contribute to business operations are excluded.

- Life insurance proceeds: Proceeds from life insurance policies are removed from earnings as they are non-recurring.

- Restructuring costs: One-time restructuring costs are excluded to reflect a more accurate earnings figure.

2. Discretionary Items

Discretionary adjustments account for expenses paid to owners of private businesses that wouldn’t exist in a publicly traded company. For instance, excessive owner compensation or personal expenses (lavish automobiles, non-business travel, etc.) are adjusted to reflect market rates.

Single Period Capitalization Method

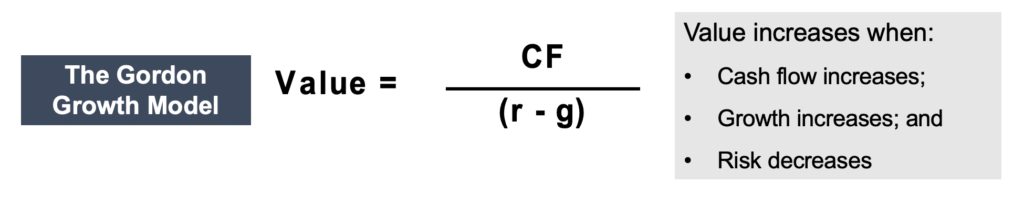

Once the earnings are adjusted, the next step is to capitalize the economic benefits. The simplest method is the single period capitalization model, which is essentially a simplified version of the discounted cash flow (DCF) method. Instead of projecting detailed future cash flows, this method uses a base level of annual cash flow and a sustainable growth rate.

In this approach, the business’s value is determined by the present value of its future economic benefit stream. The formula used for this method involves a capitalization rate, which reflects the business’s risk and expected growth. The higher the growth, the higher the business’s value, and vice versa.

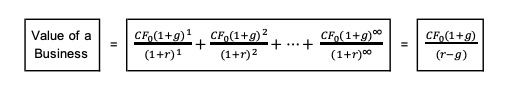

The value of any operating asset/investment is equal to the present value of its expected future economic benefit stream.

If the growth in cash flows is constant, this can be simplified:

Where

CF = Next year’s cash flow

g = perpetual growth rate

r = discount rate for projected cash flows

The denominator of the expression on the right (r – g) is referred to as the “capitalization rate,” and its reciprocal is the familiar “multiple” that is applicable to next year’s cash flow. The multiple (and thus the firm’s value) is negatively correlated to risk and positively correlated to expected growth.

There are two primary methods for determining the capitalization rate:

- Public guideline company analysis

- Build-up analysis, which factors in risk, capital structure, and other variables.

Discounted Cash Flow (DCF) Method

The discounted cash flow (DCF) method is another common approach to valuing a business. This method is particularly useful when a business is expected to experience varying or near-term accelerated growth. In this method, cash flows are projected for a discrete period, after which the business is assumed to grow at a steady rate into perpetuity.

The DCF model can be broken down into three key elements:

1. Projected Future Cash Flows

Future cash flows are forecasted for as many periods as needed (typically 3-10 years) until the business reaches a stabilized earnings stream. Ideally, these projections are based on management estimates, but if unavailable, they can be developed by the valuation professional based on historical performance, industry data, and conversations with management. Comparing historical performance with projected cash flows is critical for ensuring the accuracy of the forecasts.

2. Discount Rate

The discount rate converts future cash flows into their present value. It reflects the risks associated with the business, including market, industry, and company-specific risks. Other factors, such as the company’s size, capital structure, and financial leverage, are also taken into account when determining the discount rate.

3. Terminal Value

After the discrete projection period, the terminal value represents the business’s value into perpetuity. This value is based on the terminal growth rate, the discount rate, and the final year’s projected cash flow. The terminal value is then discounted and added to the present value of the projected cash flows.

Conclusion

The income approach is a powerful method for valuing a business by converting future financial performance into present value. Whether using the single-period capitalization method or the discounted cash flow method, analysts must carefully select the most appropriate approach based on the business’s unique circumstances.

It’s crucial to apply these methods thoughtfully and adjust financials to reflect the true operating earnings of the business. In doing so, the income approach provides a comprehensive and reliable valuation. For accurate and insightful results, businesses should consult with a competent valuation expert who can ensure that all nuances and variables are accounted for.

Also read: How to do Valuation Analysis of any Company?

Leave a Reply