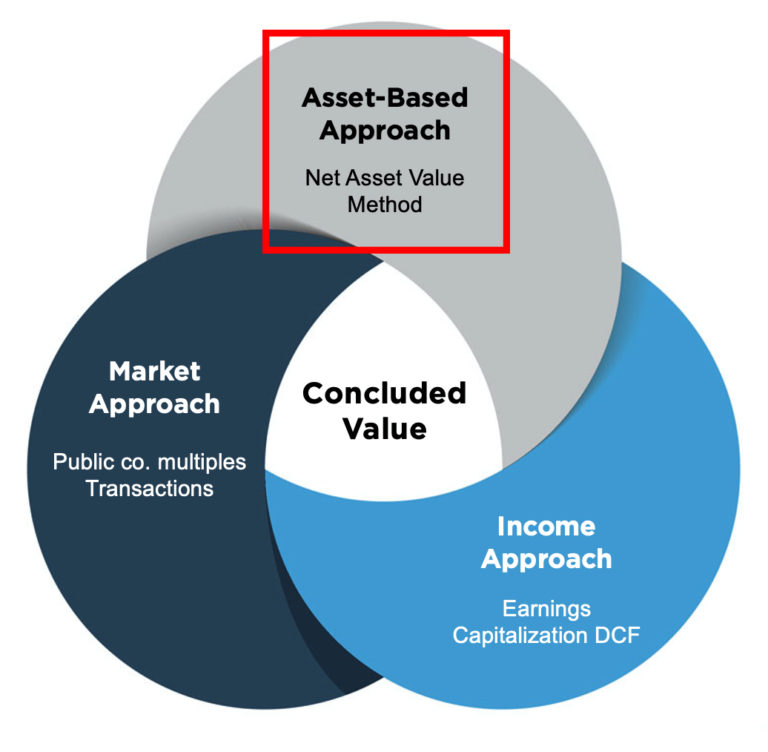

In business valuations, there are three main approaches: the income approach, the market approach, and the asset approach. This article provides a comprehensive overview of the asset approach—a method that values a business based on its net assets. While each approach should be considered, the specific one used depends on the unique circumstances of the business being evaluated.

What Is the Asset Approach and How Is It Utilized?

The asset approach values a business by assessing its assets and liabilities, essentially viewing the business as an assemblage of net assets. Appraisers begin with the company’s balance sheet, which lists the assets, liabilities, and equity. These values are typically based on accounting standards (book values), which may not always align with current market values. The appraiser will adjust the values to reflect their market equivalents.

To determine the business’s value, the Net Asset Value (NAV) is calculated by subtracting the market value of the company’s liabilities from the market value of its assets.

This approach is particularly useful for valuing real estate holding companies, investment holding companies, and capital-intensive businesses. However, for operating companies, the asset approach might not reflect the full value if the business generates more earnings than its assets suggest.

Applications of the Asset-Based Approach

The asset-based approach is often applied in the following scenarios:

1. Mergers and Acquisitions (M&A)

In M&A, the asset-based approach offers a robust framework for accurately assessing the value of tangible assets like buildings, land, and machinery. This is especially relevant in industries such as manufacturing, mining, real estate, and utilities, where tangible assets play a significant role.

2. Bankruptcy or Liquidation Scenarios

For companies facing financial distress or liquidation, this method provides a clear estimate of the potential recovery value from selling off assets. It is particularly helpful for buyers and sellers considering the acquisition of a company’s assets rather than its operations.

3. Valuing Asset-Rich Companies

The asset-based approach is often used for companies with substantial holdings in tangible and intangible assets, such as holding companies, investment firms, and other asset-rich businesses. These entities typically have large investments in assets, making this method highly relevant.

Asset Classes and Common Balance Sheet Adjustments

In the asset approach, assets and liabilities are carefully evaluated, with adjustments made as necessary to reflect market values. Assets generally fall into the following categories:

1. Financial Assets

This includes cash, marketable securities, accounts receivable, and prepaid expenses. These assets usually require minimal adjustments, as their book values often reflect current market values.

2. Inventory

Inventory may need to be adjusted based on economic realities. For example, obsolete inventory might require a downward adjustment, while rising market values (e.g., commodities) could warrant an upward adjustment.

3. Tangible Real Property

Tangible real property, including furniture, fixtures, and equipment, is subject to depreciation over time. Appraisers will adjust these assets based on their market value, factoring in actual economic depreciation versus accounting depreciation.

4. Real Estate

Real estate assets may appreciate or depreciate over time. Therefore, current appraisals are often required to determine the real estate’s accurate market value.

5. Intangible Assets

Although intangible assets such as intellectual property, goodwill, and customer relationships may be on the balance sheet, they are typically excluded from the asset approach as it focuses on tangible, operating assets.

Advantages & Disadvantages of the Asset-Based Approach

Pros

- Provides a minimum value for a business, particularly in liquidation scenarios.

- The core process—assets minus liabilities—is straightforward, even if adjustments to certain assets or liabilities require expertise.

- Useful for liquidation or dissolution situations.

- Offers flexibility in choosing which assets and liabilities to include and how to measure their value.

Cons

- Does not account for the company’s future earning potential.

- The business’s overall value might be higher than the sum of its assets, especially when considering intangible assets like brand reputation or intellectual property.

- Valuing intangible assets can be complex.

- The asset-based approach ignores factors such as market sentiment and industry trends that affect market value.

- An accurate asset-based valuation requires significant expertise, attention to detail, and objectivity, which many businesses may lack.

The asset-based approach can be useful for determining the business’s liquidation value, but it has limitations. It’s recommended to use this method alongside other valuation approaches to get a more comprehensive view of a company’s true worth.

Conclusion

The asset approach is a straightforward and intuitive method of business valuation, particularly for companies that hold significant tangible assets or operate in capital-intensive industries. While it is ideal for certain scenarios—such as mergers and acquisitions or liquidation—it does not always capture the full value of an operating business, especially one with substantial intangible assets or strong future earnings potential.

For businesses with complex balance sheets or substantial intangible assets, it is crucial to work with a professional valuation expert who can apply the asset approach appropriately while considering other valuation methods to provide a comprehensive view of the business’s value.

Also Read: How to do Valuation Analysis of any Company?

Leave a Reply