Investing in the stock market requires patience and diligence. Before committing your hard-earned money to a business, it is crucial to evaluate its financial health and future growth prospects. This evaluation significantly impacts the profitability of your investment. One of the most effective ways to assess if a stock is worth your investment is through valuation analysis.

Valuation is the process of determining the intrinsic value of a company’s stock. It involves various methods to assess whether a company is overvalued, undervalued, or trading at fair value. Understanding how to conduct a valuation analysis is essential to making informed investment decisions. In this article, we will explore the different methods used in valuation analysis and how they help assess a company’s viability as an investment option.

Methods of Valuation of a Company

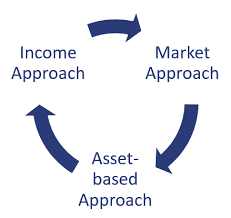

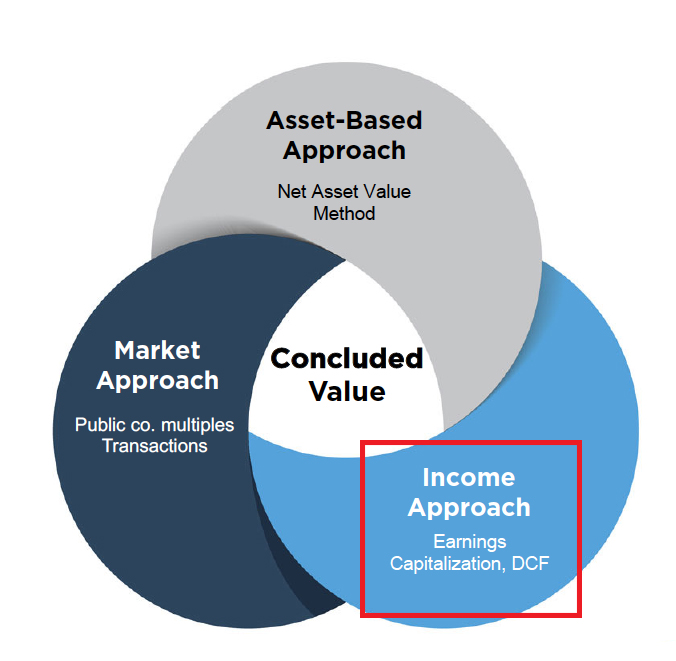

If you’re wondering how to calculate the valuation of a company, several approaches can be used. Below are the three primary methods used for company valuation:

1. Income Approach

The Income Approach, also known as the Discounted Cash Flow (DCF) method, is one of the most popular techniques for determining a company’s intrinsic value. This approach involves discounting the company’s future cash flows to their present value using the company’s cost of capital.

To use the DCF method, future cash flows are projected and then discounted to the present day using the company’s weighted average cost of capital (WACC). By comparing the present value of future cash flows with the stock’s current price, investors can assess whether the stock is overvalued, undervalued, or fairly priced.

This method is highly effective for companies with predictable and stable cash flows, making it a go-to approach for financial analysts when conducting stock valuation.

Also Read: Understanding the Income Approach in Business Valuation

2. Asset Approach

The Asset Approach, often referred to as the Net Asset Value (NAV) method, calculates the company’s value based on the fair market value of its assets, minus its liabilities. This approach is particularly useful for companies with significant tangible assets, where it’s easier to determine the fair value.

NAV is calculated using the following formula:

NAV = Fair Value of All Assets – Total Liabilities

Fair value adjustments are necessary to ensure that the asset values reflect their true worth, not just their purchase price or recorded book value. In some cases, intrinsic costs like replacement cost must be factored in, making this method slightly complex. For example, if the company has a key employee whose expertise is critical to the business, the cost of replacing that employee could be included in the valuation.

The Asset Approach is typically used in industries where tangible assets play a key role, such as manufacturing or real estate, to ensure the asset value aligns closely with the stock value.

3. Market Approach

Also known as the Relative Valuation method, the Market Approach compares the company’s valuation to similar companies in the industry. This method uses financial metrics such as Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and Price-to-Book Value (P/BV) ratio to gauge the company’s relative worth.

Here are some key financial ratios used in market-based valuation:

- P/E Ratio (Price to Earnings Ratio): This ratio compares the stock price to its earnings per share (EPS). It is calculated using the formula:

P/E Ratio = Stock Price / Earnings per ShareWhile widely used, the P/E ratio has limitations due to potential distortions in the earnings figure caused by different accounting methods. For a more accurate picture, it’s essential to consider the company’s profit track record. - P/S Ratio (Price to Sales Ratio): This ratio evaluates the company’s market capitalization relative to its total annual sales. It is calculated as:

P/S Ratio = Stock Price / Net Annual Sales per ShareThe P/S ratio is less distorted than the P/E ratio because sales are less affected by accounting adjustments, making it especially useful for companies with inconsistent profits. - P/BV Ratio (Price to Book Value Ratio): This traditional method calculates the price investors are willing to pay for each unit of book value. It is determined by:

P/BV Ratio = Stock Price / Book Value per ShareThe P/BV ratio is a favorite among value investors and is often used in sectors like banking, where asset value plays a significant role in earnings. - EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization): This metric provides a clearer view of a company’s operational profitability. The EBITDA to Sales Ratio is calculated as:

EBITDA to Sales Ratio = EBITDA / Net SalesEBITDA is less influenced by tax rates, interest payments, and capital structure, making it a reliable figure for comparing companies.

Summing Up: How to Do Valuation Analysis of a Company

Valuation analysis is critical for determining whether a stock is fairly priced, overvalued, or undervalued. Investing in overvalued stocks can lead to capital loss, while undervalued stocks may present opportunities for significant gains. Conducting a thorough valuation analysis, along with financial ratio analysis, can provide investors with a holistic view of a company’s potential.

In conclusion, mastering valuation analysis is essential for making informed investment decisions and safeguarding your portfolio from potential risks. Whether you are using the Income Approach, Asset Approach, or Market Approach, each method has its unique advantages and is suitable for different types of companies.

We hope this guide has helped you understand how to perform a valuation analysis of a company. By analyzing a company’s financial health, future growth prospects, and industry positioning, you can invest with greater confidence and improve your chances of success in the stock market.

Happy Investing!

Leave a Reply