Category: Investing

-

Business Valuation: 6 Methods for Valuing a Company

What Is a Business Valuation? Business valuation, also known as company valuation, is the process of determining the economic value of a business. During this process, all aspects of the business are analyzed to determine its overall worth, as well as the value of specific departments or units. Valuations are commonly used during mergers and…

-

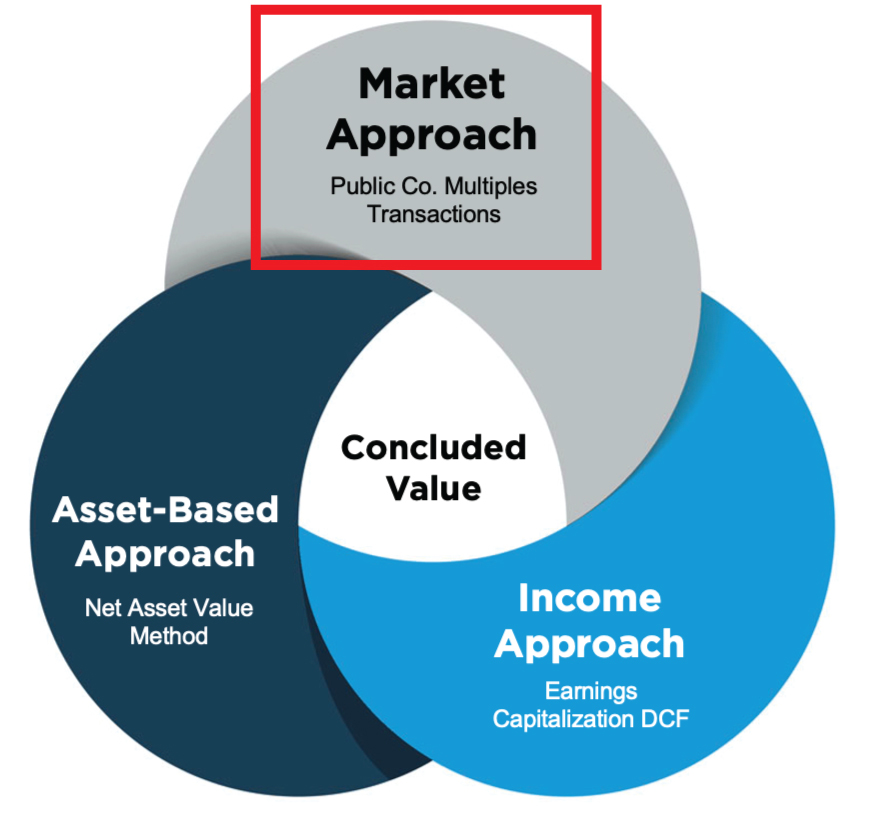

Understanding the Market Approach in Business Valuation

A thoughtful business valuation typically involves multiple approaches to derive an accurate value. One of the three key methods used in business valuation is the market approach, along with the income approach and asset approach. In this article, we’ll focus on the market approach, which involves comparing the subject company to similar businesses that have…

-

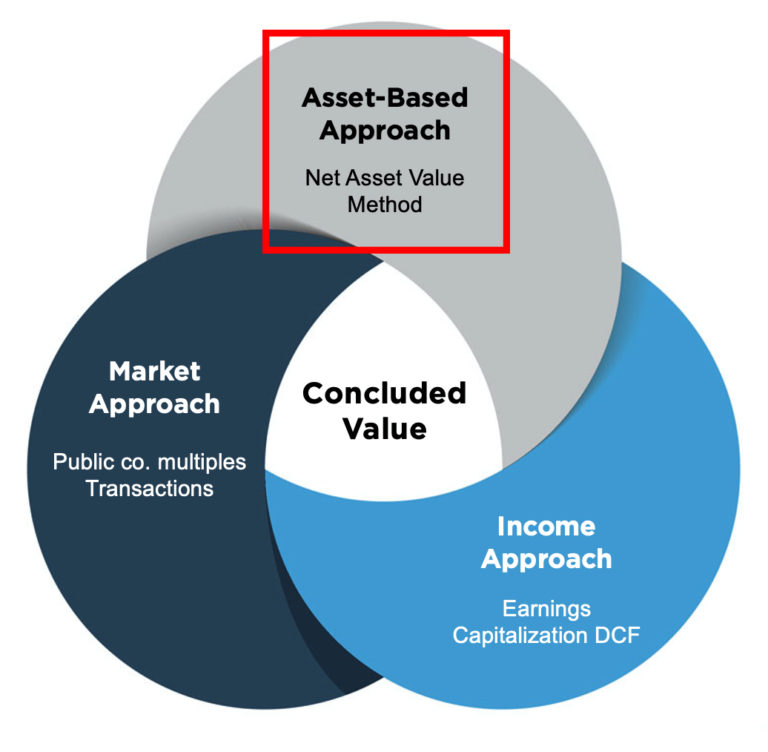

Understanding the Asset Approach in Business Valuation

In business valuations, there are three main approaches: the income approach, the market approach, and the asset approach. This article provides a comprehensive overview of the asset approach—a method that values a business based on its net assets. While each approach should be considered, the specific one used depends on the unique circumstances of the…

-

Understanding the Income Approach in Business Valuation

When valuing a business, analysts rely on three primary approaches: the market approach, the income approach, and the asset-based approach. In this article, we’ll provide an in-depth look at the income approach, one of the most commonly used methods in business valuation. The asset-based approach will be covered in a future article. Each approach should…

-

How to do Valuation Analysis of any Company?

Investing in the stock market requires patience and diligence. Before committing your hard-earned money to a business, it is crucial to evaluate its financial health and future growth prospects. This evaluation significantly impacts the profitability of your investment. One of the most effective ways to assess if a stock is worth your investment is through…

-

What is Book Building Process in IPOs and Why It’s Important?

When companies decide to go public through an Initial Public Offering (IPO), determining the right share price is crucial. One widely used method for setting this price is the Book Building process, which plays a key role in ensuring that new shares are priced accurately before being offered to the public. In this article, we’ll…

-

Hyundai Motor IPO: Key Details, Latest GMP, and Major Risks—Top 10 Things Investors Should Know Before the IPO Opens

The Hyundai Motor India IPO is set to be one of the most significant events in India’s capital markets this year, potentially surpassing the scale of the LIC IPO in 2022. The public issue, opening for subscription from October 15 to October 17, 2024, will see shares of the Indian subsidiary of Hyundai Motor Company…

-

Wipro Board to Consider Bonus Share Issue Alongside Q2 Results for 2024

Wipro Ltd to Consider Bonus Share Issue in Upcoming Board Meeting on October 17, 2024 Wipro Ltd’s board of directors is set to review a proposal for a bonus issue of shares during its board meeting scheduled for October 16-17, 2024. According to a filing with the Bombay Stock Exchange (BSE) on Sunday, October 13,…