Author: Aditya

-

5 Best Term Insurance Policies in India (2025): A Comprehensive Guide

Term insurance is one of the most cost-effective ways to secure your family’s financial future in case of an unfortunate event. With the increasing awareness of financial planning, term insurance has become a crucial part of every individual’s portfolio. In this blog, we’ll dive deep into the 5 best term insurance policies in India for 2025,…

-

Chapter 4. The IPO Markets (Part 1)

Overview The initial three chapters set the background on basic market concepts you need to know. It becomes necessary to address a fundamental question at this stage – Why do companies go public? A good understanding of this topic lays a sound foundation for all future topics. In this and the next chapter, we will…

-

Top 10 Tax Saving Options for Salaried Employees in India (2025 Guide)

Tax planning is a crucial aspect of financial management for salaried employees in India. With the right tax-saving strategies, you can significantly reduce your tax liability and maximize your savings. The Income Tax Act, 1961, offers various provisions that allow salaried individuals to save tax while building a secure financial future. In this comprehensive guide,…

-

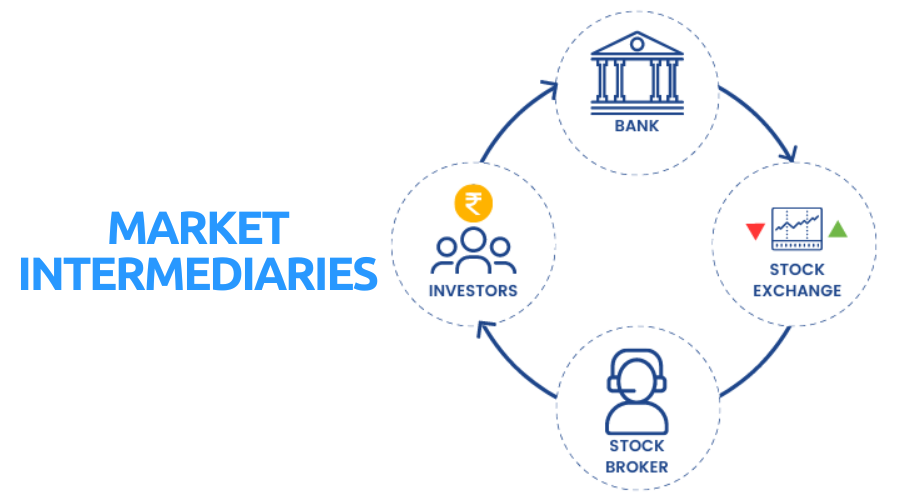

Chapter 3. Market Intermediaries

Overview Many corporate entities work in tandem to ensure transactions in the market flow smoothly. Right from the time you log in to a trading terminal (let’s say to buy shares), to the time these shares hit your DEMAT account, market intermediaries work seamlessly together to ensure your transactions flow without any hiccups. These entities…

-

Chapter 2: Regulators and Key Players in the Stock Market

What is the stock market? In the previous chapter, we established that investing in equities is vital to generate inflation-beating returns. Having said that, how do we go about investing in equities? Before we dwell further into this topic, it is essential to understand the market ecosystem and the many different entities involved in making…

-

Chapter 1: Why should anyone invest?

Before we address the above question, let us understand what would happen if one chooses not to invest. Assume you earn Rs.50,000/- per month, and you spend Rs.30,000/-towards your day-to-day living; this can include expenses like housing, food, transport, shopping, medical, etc. The balance of Rs.20,000/- is your monthly surplus. For the sake of simplicity,…

-

What is Buildings Insurance? Do I need one?

Buildings insurance covers the cost of repairing or rebuilding the structure of your home if it gets damaged. This includes essential elements like the roof, walls, floors, and permanent fixtures such as your kitchen and bathroom. Additionally, outside structures connected to your home—like garages, sheds, and pipes—are usually covered. Do I Need Buildings Insurance for…